The Economics Behind: A Startup’s Optimum Capital Structure [Start up Debt series - Part I]

The capital structure of a company denotes the blend of equity and debt financing employed to underwrite its assets. Certain companies may be entirely reliant on equity financing, devoid of any debt, while others may exhibit minimal equity and substantial debt burden. Determining the optimal mix of equity and debt capital is not a straightforward endeavour; rather, it hinges on the specific circumstances of a company, including its stage in the business lifecycle, operational model, customer base, and nuances of working capital.

Ascertaining Optimal Capital Structures is imperative for a business to grow, scale and generate optimum returns for all stakeholders. However, Startups in particular are heavily reliant on equity due to the paucity of debt avenues available to them.

Debt assumes a significant role in establishing an optimal capital structure within any business framework. Debt fulfills various functions, including bridging financial gaps, providing long-term capital for project expansions, facilitating acquisitions, offering bridge financing, and addressing similar operational requirements.

Equity, on the other hand, allocated to more risky aspects of business operations and facilitates transitions into novel business models that have yet to secure market viability.

Given the inherent risks associated with the early stage ecosystem, equity assumes a prominent position, particularly during the nascent stages of a startup's trajectory. However, as the startup progresses along its lifecycle, the composition of its capital structure often fails to incorporate debt as a necessary component of the capital mix.

Reasons for Debt’s Low Prevalence in Startup Capital Structures

Easy Access to Equity

In the past decade, venture capital has gained significant prominence as an asset class, particularly in India. Equity investors in this domain have played a crucial role in shaping the capital structure of Indian startups, contributing substantially to their growth through strategic financial deployment.

Despite challenges like the current "Funding winter," there remains a substantial pool of unallocated capital awaiting investment. In 2022, 70 India-focused Private Equity (PE) and Venture Capital (VC) entities closed funds amounting to a record-high annual fundraising value of $8.5 billion, leading to a significant increase in PE/VC dry powder from $11.1 billion in 2021 to $15.6 billion by the end of 2022.

This abundance of financial resources has spurred a noticeable trend among Indian startups, with many preferring equity as their primary means of capital infusion.

Paucity of Profits due to High Rate of Growth

The business dynamics model for early-stage startups emphasises rapid growth over profitability. This approach involves allocating substantial financial resources to research & development, infrastructure expansion, GTM (Go-To-Market) strategies, and revenue retention & expansion, prioritizing strategic imperatives over immediate financial gains. However, this focus on growth often results in a lack of profitability, leading debt providers to resist supporting such startups due to their high-risk profile.

The absence of consistent profitability metrics challenges conventional risk assessment mechanisms that are based on historical data gathered from records of traditional businesses growing incrementally rather than in a step function manner as prevalent with startups, especially venture backed startups.

Lack of prevalence of Tangible Assets as a Means of Security

The absence of tangible assets in technology-focused startups presents a major challenge for lenders. Unlike traditional industries with tangible collateral like real estate or machinery, startups rely on intangible assets such as intellectual property or technological innovation for value creation. This lack of tangible assets complicates traditional underwriting strategies that depend on collateralization. Lenders face increased uncertainty about loan repayment and the effectiveness of recourse mechanisms in case of default due to the absence of tangible assets.

Inability to Ascertain Consistent Cashflow

The incapacity of startups to ascertain a consistent stream of cash flows also poses a formidable challenge when it comes to comfort in underwriting strategies. Unlike established enterprises with established revenue streams and predictable cash flow patterns, startups often grapple with volatility and uncertainty.

This lack of consistency in cash flows entails a rethink of the standardised underwriting strategies developed by debt providers and the adoption of alternate substantive procedures to provide comfort to prospective lenders.

Understanding the Key Components of Capital Structure

Earlier in the article, we examined the fundamental elements comprising capital structures: Equity and Debt, delving into the necessity and significance of each instrument concerning the advancement of an early-stage enterprise. However, the convergence of these two components to achieve an optimal capital structure remains an essential consideration. To better understand this concept, it is imperative to deconstruct the term "Weighted Average Cost of Capital" (WACC).

Understanding WACC

Weighted average cost of capital or WACC for short, is the simple weighted average cost of capital of all financial sources of funding. Typically for an early stage company this would be the cost of equity raised from the venture capital ecosystem and the cost of debt raised by the debt/credit ecosystem.

An Indicator of Market Capitalisation

WACC serves as a pivotal indicator in assessing the market capitalization of companies, offering valuable insights into their financial health and valuation. It reflects the minimum return required by investors to compensate for the risk associated with investing in the company, be it equity or debt capital.

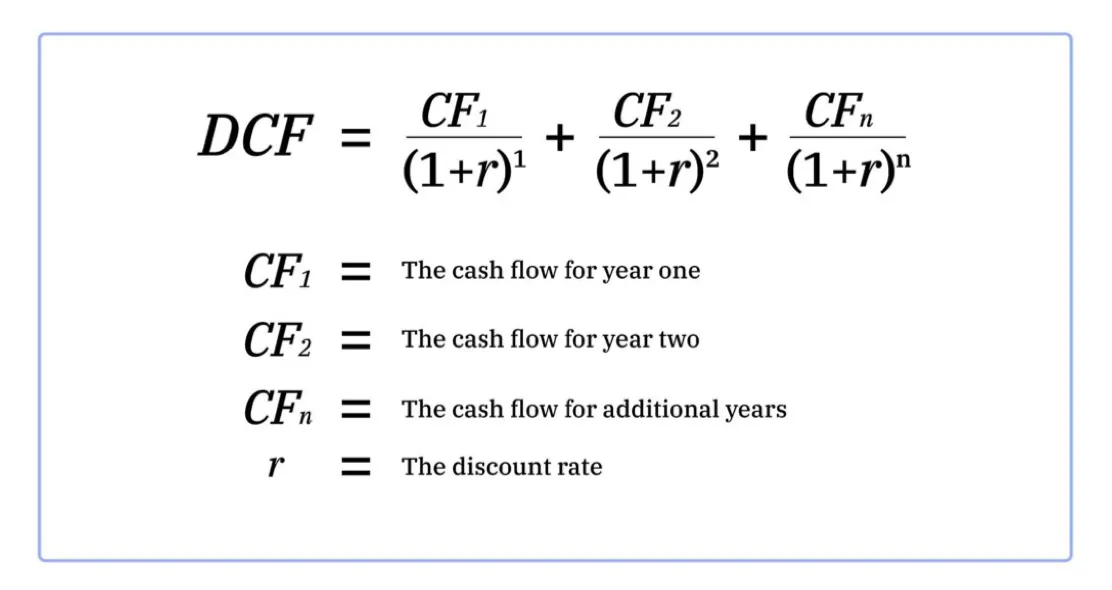

Within the framework of the Discounted Cash Flow (DCF) methodology employed for company valuation, the Weighted Average Cost of Capital (WACC) emerges as the primary metric utilised to discount the anticipated future cash flows of a company based on its projection estimates. This process facilitates the derivation of the present equity value of the company as of a specified date. Widely acknowledged in the VC ecosystem, this methodology is adopted for valuing early-stage startups characterised by a lack of operational history and the absence of consistent or predictable cash flows.

Additional considerations come into play when evaluating a company's value. Nevertheless, as a guiding principle, companies with a lower Weighted Average Cost of Capital (WACC) typically command a higher market capitalisation. This perception stems from their perceived lower risk, given their capacity to generate returns surpassing their capital costs. Conversely, companies with higher WACC may demonstrate lower market capitalization, indicative of heightened risk and potentially reduced anticipated returns for investors.

Current Economics of Cost of Debt and Equity

Understanding the Cost of Debt for a startup entails an analysis of various credit instruments commonly utilized within the startup ecosystem. These instruments [unsecured] primarily include Fixed deposit-backed Overdraft facilities, Venture Debt, and Revenue-based financing (RBF).

Fixed deposit-backed Overdraft facilities typically incur a simple interest cost ranging from 1-3% above the prevailing fixed deposit rate, which currently hovers between 7-8%. While this instrument offers the lowest cost for startups initially, it necessitates collateral in the form of fixed deposits, often equivalent to or exceeding 100% of the credit availed. Over time, as the startup demonstrates consistent repayment behavior, lenders may reduce the cash margin requirement, thus providing the startup with greater leverage.

Venture Debt, characterised by a simple interest rate ranging from 14-18%, is widely utilized within the startup ecosystem. It offers startups the flexibility of term loans and Overdraft facilities, aiding in extending runway or managing working capital requirements.

Revenue-based financing (RBF) involves lenders providing capital to startups in exchange for a percentage of the company's ongoing total gross revenues, typically with simple interest rates ranging between 15-20%. The percentage of revenue to be paid depends on factors such as the interest rate, loan tenure, and the startup's creditworthiness.

The overall cost of debt for startups thus falls within the range of 11-20%, contingent upon the chosen credit instrument.

Conversely, determining the Cost of Equity for startups is more intricate. Startup stage significantly influences the Cost of Equity, as each stage carries distinct risks. Early-stage startups, being riskier, generally face a higher cost of capital compared to later-stage counterparts, which exhibit lower risk profiles.

According to a report by EY, over 50% of startups report an average cost of equity exceeding 20%, with an additional 13% indicating costs ranging between 18-20%.

Let's understand this better through a simple example

Company A is a Seed Stage startup that has just raised INR 5 Cr of equity funding from venture capital investors.

The company is in the hardware manufacturing sector producing televisions and has a manufacturing cycle of 3 months [Inventory holding cycle] to complete the production of one unit for sale. Let us assume the requirement of production for this 3 month cycle is INR 1 Cr. Once manufacturing has been completed and the television has been sold, the company provides the customer with a credit period of 1 month from the date of the sale [Receivable days cycle].

Due to the protracted sales cycle, the company is unable to convert the capital outflow used for manufacturing the television into free cash inflows for the entirety of the Inventory cycle and Receivable says cycle resulting in what is called a “working capital block”.

For this particular credit use case, the company would ideally seek to avail an overdraft facility as the objective is to alleviate the working capital burden for the rolling period of the inventory holding and receviable days cycle.

A lender is also comfortable to fund the company this overdraft facility at the rate of 10% [8% FD (+) 2% interest]

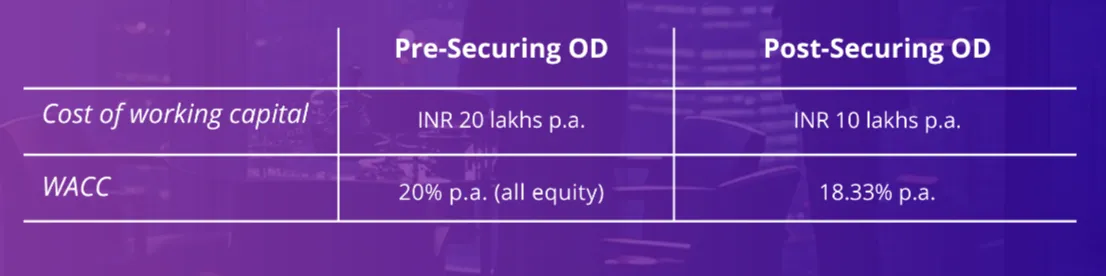

Now what would the capital structure of the company be pre and post securing the debt facility:

Weighted average cost of capital [applying the formula discussed earlier]: 18.33% p.a. on the combined capital of INR 6 Cr. [excluding taxation for the sake of simplicity]

What should be Your Optimum Capital Structure

Determining the optimal capital structure for your company does not adhere to a singular correct path. The Weighted Average Cost of Capital (WACC) exhibits significant variation across industries, geographical regions, the maturity of companies, creditworthiness, the capacity to access low-cost capital, and numerous other factors. It is also crucial to regularly review and adjust WACC based on changes in the business environment and strategic priorities.

A seed stage company with a substantial proportion of debt relative to equity might still encounter a higher WACC in comparison to a publicly listed entity financed entirely through equity.

While establishing a definitive benchmark for WACC tailored to your company may pose challenges, the overarching objective should consistently revolve around minimising your WACC. However, there are other considerations to be taken into account in this exercise:

- Risk and return trade-off: Minimising WACC often involves reducing risk, but this might not always align with the company's growth objectives or risk tolerance. Sometimes, particularly for startups, taking on additional risk may be necessary to pursue growth opportunities.

- Investment decisions: Lowering WACC might involve actions, such as reducing debt or optimizing the capital structure. While these actions can lower WACC, they may also limit the company's ability to undertake certain investments or projects that require leverage.

- Market conditions: External factors, such as interest rates or market sentiment, can significantly influence WACC. Attempting to minimize WACC in volatile market conditions may not always be feasible or advisable.

Minimising WACC is definitely a worthwhile objective for start ups, but it needs to be approached holistically, considering the company's risk appetite, growth objectives, and prevailing market conditions.

DISCLAIMER

The views expressed herein are those of the author as of the publication date and are subject to change without notice. Neither the author nor any of the entities under the 3one4 Capital Group have any obligation to update the content. This publications are for informational and educational purposes only and should not be construed as providing any advisory service (including financial, regulatory, or legal). It does not constitute an offer to sell or a solicitation to buy any securities or related financial instruments in any jurisdiction. Readers should perform their own due diligence and consult with relevant advisors before taking any decisions. Any reliance on the information herein is at the reader's own risk, and 3one4 Capital Group assumes no liability for any such reliance.Certain information is based on third-party sources believed to be reliable, but neither the author nor 3one4 Capital Group guarantees its accuracy, recency or completeness. There has been no independent verification of such information or the assumptions on which such information is based, unless expressly mentioned otherwise. References to specific companies, securities, or investment strategies are not endorsements. Unauthorized reproduction, distribution, or use of this document, in whole or in part, is prohibited without prior written consent from the author and/or the 3one4 Capital Group.

.webp)